Garnishment and Attachment Regulations

SOR/83-212

GARNISHMENT, ATTACHMENT AND PENSION DIVERSION ACT

Registration 1983-03-04

Regulations Respecting Garnishment and Attachment Proceedings

P.C. 1983-658 1983-03-03

His Excellency the Governor General in Council, on the recommendation of the Minister of Justice, pursuant to sections 9, 12, 14, and 19 of the Garnishment, Attachment and Pension Diversion ActFootnote *, is pleased hereby to make the annexed Regulations respecting garnishment and attachment proceedings.

Return to footnote *S.C. 1980-81-82, c. 100

Short Title

1 These Regulations may be cited as the Garnishment and Attachment Regulations.

Interpretation

2 In these Regulations,

- Act

Act means the Garnishment, Attachment and Pension Diversion Act. (Loi)

- debtor

debtor[Repealed, SOR/97-176, s. 1]

- SOR/97-176, s. 1

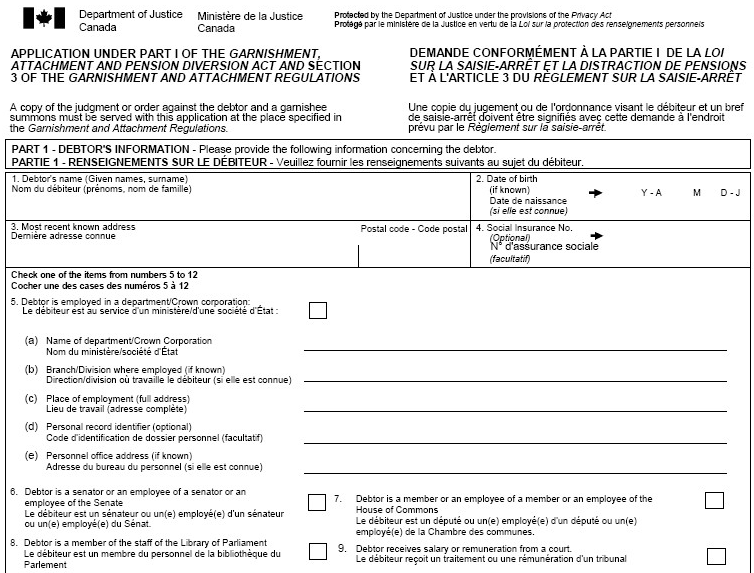

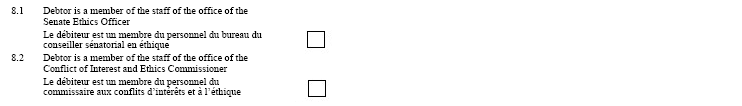

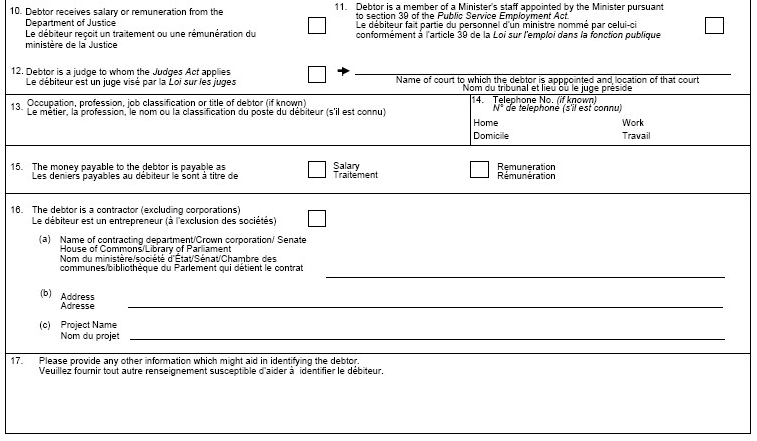

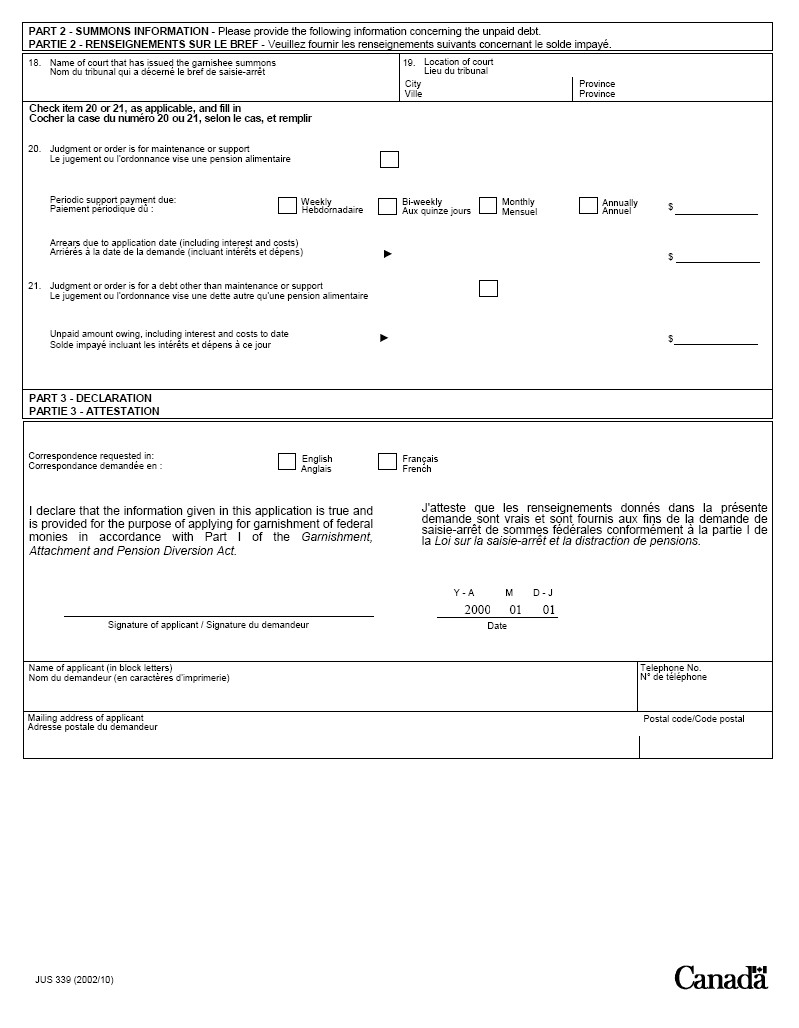

Information to Be Contained in a Garnishment Application

3 An application referred to in subsection 6(1) or 18(1) of the Act shall be in the form set out in the schedule.

- SOR/84-47, s. 1

- SOR/97-176, s. 2

Service of Documents

4 (1) Subject to subsections (2) and (3), service of documents on Her Majesty in connection with garnishment proceedings permitted by Division I of Part I of the Act including those in relation to the Canada Post Corporation in respect of a debtor must be effected at the following places:

(a) if the garnishee summons is issued or will be issued by a court located in Newfoundland and Labrador,

- Canada Revenue Agency

- 290 Empire Avenue

- St. John’s, Newfoundland

- A1C 6L9

- Attention: Garnishment Registry;

(b) if the garnishee summons is issued or will be issued by a court located in Prince Edward Island,

- Department of Justice,

- Legal Services Unit — Veterans Affairs Canada,

- P.O. Box 7700,

- Charlottetown, Prince Edward Island

- C1A 8M9

- Attention: Garnishment Registry;

(c) where the garnishee summons is issued or will be issued by a court located in Nova Scotia,

- Department of Justice

- Halifax Regional Office

- Suite 1400

- Duke Tower

- 5251 Duke Street

- Halifax, Nova Scotia

- B3J 1P3

- Attention: Garnishment Registry;

(d) where the garnishee summons is issued or will be issued by a court located in New Brunswick,

- Office of The Director-Taxation,

- 65 Canterbury Street,

- P.O. Box 6300,

- Postal Station “A”,

- Saint John, New Brunswick

- E2L 4H9

- Attention: Garnishment Registry;

(e) where the garnishee summons is issued or will be issued by a court located in Quebec, other than in that part of the National Capital Region referred to in subparagraph (f)(ii),

- Department of Justice

- Montreal Regional Office

- 9th Floor, East Tower

- 200 René Lévesque Boulevard West

- Montreal, Quebec

- H2Z 1X4

- Attention: Garnishment Registry;

(f) where the garnishee summons is issued or will be issued by a court located in

(i) the following counties, districts or judicial district of Ontario, namely,

(A) District of Algoma,

(B) District of Cochrane,

(C) County of Frontenac,

(D) District of Kenora,

(E) County of Lanark,

(F) Counties of Leeds and Grenville,

(G) Counties of Lennox and Addington,

(H) District of Manitoulin,

(I) District of Nipissing,

(J) Judicial District of Ottawa-Carleton,

(K) District of Parry Sound,

(L) Counties of Prescott and Russell,

(M) County of Prince Edward,

(N) District of Rainy River,

(O) County of Renfrew,

(P) Counties of Stormont, Dundas and Glengarry,

(Q) District of Sudbury,

(R) District of Temiskaming, and

(S) District of Thunder Bay, or

(ii) that part of the National Capital Region located in Quebec,

- Department of Justice,

- Justice Building,

- P.O. Box 2730, Station D

- Ottawa, Ontario

- K1P 5W7

- Attention: Garnishment Registry;

(g) where the garnishee summons is issued or will be issued by a court located in Ontario, other than the counties, districts or judicial district referred to in subparagraph (f)(i),

- Department of Justice

- Toronto Regional Office

- 2 First Canadian Place

- Box 36

- Toronto, Ontario

- M5X 1K6

- Attention: Garnishment Registry;

(h) where the garnishee summons is issued or will be issued by a court located in Manitoba;

- Department of Justice,

- Winnipeg Regional Office,

- 301 Centennial House,

- 310 Broadway Avenue,

- Winnipeg, Manitoba

- R3C 0S6

- Attention: Garnishment Registry;

(i) if the garnishee summons is issued or will be issued by a court located in Saskatchewan,

- Department of Justice

- Saskatoon Regional Office

- Scotia Centre

- 10th Floor, 123-2nd Avenue South

- Saskatoon, Saskatchewan

- S7K 7E6

- Attention: Garnishment Registry;

(j) where the garnishee summons is issued or will be issued by a court located in Alberta,

- Department of Justice

- Edmonton Regional Office

- Suite 211

- 10199 - 101 Street

- Edmonton, Alberta

- T5J 3Y4

- Attention: Garnishment Registry;

(k) where the garnishee summons is issued or will be issued by a court located in British Columbia,

- Department of Justice

- Vancouver Regional Office

- Suite 900

- 840 Howe Street

- Vancouver, British Columbia

- V6Z 2S9

- Attention: Garnishment Registry;

(l) where the garnishee summons is issued or will be issued by a court located in the Northwest Territories,

- Department of Justice,

- Yellowknife Regional Office, Box 8,

- Yellowknife, Northwest Territories

- X1A 2N1

- Attention: Garnishment Registry;

(m) if the garnishee summons is issued or will be issued by a court located in Yukon,

- Whitehorse Crown Attorney’s Office

- Department of Justice Canada, Northern Region

- Yukon Regional Office

- Suite 200

- 300 Main Street

- Whitehorse, Yukon

- Y1A 2B5

- Attention: Garnishment Registry; and

(n) if the garnishee summons is issued or will be issued by a court located in Nunavut,

- Department of Justice

- Nunavut Regional Office

- P.O. Box 1030

- Iqaluit, Nunavut

- X0A 0H0

- Attention: Garnishment Registry.

(2) Service of documents on Her Majesty in connection with garnishment proceedings permitted by Division I of Part I of the Act in respect of a debtor who

(a) receives salary or remuneration from the Department of Justice,

(b) receives salary or remuneration from a court,

(c) is a judge to whom the Judges Act applies, or

(d) [Repealed, SOR/84-47, s. 2]

(e) is a member of a Minister’s staff appointed by the Minister pursuant to section 39 of the Public Service Employment Act,

must be effected at,

- Department of Justice,

- P.O. Box 2730, Station D

- Ottawa, Ontario

- K1P 5W7

- Attention: Garnishment Registry;

(3) Service of documents on Her Majesty in connection with garnishment proceedings permitted by Division I of Part I of the Act in respect of a debtor who receives salary or remuneration from a Crown corporation listed in section 6, other than the Canada Post Corporation, must be effected at the head office of the corporation.

- SOR/84-47, s. 2

- SOR/97-176, s. 3

- SOR/2002-278, s. 5

- SOR/2008-191, s. 1

4.1 Service of documents on the Senate, House of Commons, Library of Parliament, office of the Senate Ethics Officer or office of the Conflict of Interest and Ethics Commissioner in connection with garnishment proceedings permitted by Division IV of Part I of the Act in respect of a debtor must be effected at the following places:

(a) in the case of service of documents on the Senate,

- The Senate,

- c/o The Law Clerk and Parliamentary Counsel,

- Parliament Buildings,

- Ottawa, Ontario

- K1A 0A4

(b) in the case of service of documents on the House of Commons,

- House of Commons

- Legal Services

- Room 7-02

- 131 Queen Street

- Ottawa, Ontario

- K1A 0A6

- Attention: Garnishment Registry;

(c) in the case of service of documents on the Library of Parliament, at the address set out in paragraph (a) or (b);

(d) in the case of service of documents on the office of the Senate Ethics Officer,

- The Senate Ethics Office

- 90 Sparks Street,

- Room 526,

- Ottawa, Ontario

- K1P 5B4;

(e) in the case of service of documents on the office of the Conflict of Interest and Ethics Commissioner,

- The Office of the Conflict of Interest and Ethics Commissioner,

- 66 Slater Street,

- 22nd Floor,

- Ottawa, Ontario

- K1A 0A6.

- SOR/84-47, s. 3

- SOR/97-176, s. 4

- SOR/2002-278, s. 6

- SOR/2005-53, s. 1

- SOR/2008-191, s. 2

Exclusions from Salary

5 For the purposes of the definition salary in sections 4 and 16 of the Act, the following amounts are deemed to be or to have been excluded from a person’s salary:

(a) any contribution or payment required by law to be made out of the moneys payable to the person, including,

(i) Canada Pension Plan and Quebec Pension Plan contributions,

(ii) contributions required to be made pursuant to any Act listed in the schedule to the Act,

(iii) unemployment insurance contributions,

(iv) income tax payments, and

(v) federal and provincial statutory tax deductions;

(b) any amount that is a compulsory premium payment deducted from the moneys payable to the person for purposes of insurance or health care including,

(i) payments for a provincial medical care or hospital insurance plan,

(ii) payments for the Public Service Health Care Plan, where the person is employed outside Canada, and

(iii) payments for disability insurance under the Disability Insurance Plan or the Public Service Management Insurance Plan except where such payment is part of union membership dues or fees;

(c) any amount deducted pursuant to an Act of the Parliament of Canada other than Part I of the Act;

(d) any amount payable to the person as a remuneration supplement in respect of costs of a provincial medical care or hospital insurance plan;

(e) any amount deducted as union membership dues or fees but not including any other amount deducted and payable to a union; and

(f) any amount that is intended as a reimbursement to the person for special costs incurred by the person in the course of duties and for which the person can produce an invoice or receipt, including,

(i) a payment to a Royal Canadian Mounted Police member, to help defray the cost of upkeep and replacement of articles of uniform,

(ii) a payment to a Royal Canadian Mounted Police member, whose duties require that member to wear civilian clothing, to help defray the cost of upkeep and replacement of articles of that clothing,

(iii) a reimbursement for the cost of boots or gloves required to be worn at work where the person is a supervisory letter carrier, a part-time letter carrier or a mail dispatcher,

(iv) a payment to furnish canoes or boats or camping equipment where the person is employed as a fisheries warden or fishery guardian,

(v) an allowance paid to a pasture manager or a pasture rider in compensation for the use of that person’s horse,

(vi) a reimbursement for the loss of clothing or personal property in a marine disaster or shipwreck,

(vii) a reimbursement of costs incurred by an air traffic controller in obtaining the annual medical examination required to maintain a valid air traffic control licence,

(viii) a reimbursement of the membership fees paid to an association or institution, where membership in the association or institution is in the interests of the department on behalf of which or the Crown corporation, Senate, House of Commons or Library of Parliament on behalf of which or by which salary or remuneration is payable to the person,

(ix) a payment of a foreign service premium, a post-differential allowance or a salary equalization factor on being posted abroad or at an isolated post, and

(x) a payment of a living cost differential allowance pursuant to the Isolated Posts Directive.

- SOR/84-47, s. 4

- SOR/88-316, s. 1

- SOR/97-176, s. 5

Crown Corporations — Division I of Part I

6 For the purposes of Division I of Part I of the Act, the following Crown corporations are prescribed:

(a) Canadian Dairy Commission;

(b) Telefilm Canada;

(c) Canadian Livestock Feed Board;

(d) [Repealed, SOR/84-47, s. 5]

(e) Royal Canadian Mint; and

(f) Canada Post Corporation.

- SOR/84-47, s. 5

- 2002, c. 17, s. 15

Crown Corporations — Division II of Part I

7 For the purposes of subsection 14(2) of Division II of Part I of the Act, the following Crown corporations are prescribed:

(a) the corporations listed in Schedule A to the Public Service Superannuation Act;

(b) Canada Council for the Arts;

(c) Canada Deposit Insurance Corporation;

(d) Canadian Corporation for the 1967 World Exhibition;

(e) Canadian Saltfish Corporation;

(f) Freshwater Fish Marketing Corporation;

(g) International Development Research Centre;

(h) National Arts Centre Corporation;

(i) Petro-Canada Limited;

(j) Standards Council of Canada; and

(k) any other Crown corporation, certain officers or employees of which are deemed to be employed in the public service for the purposes of the Public Service Superannuation Act.

- 1991, c. 10, s. 19

- 2001, c. 34, s. 17

SCHEDULE / ANNEXE(Section 3 / article 3)

- SOR/84-47, ss. 6, 7

- SOR/88-316, s. 2(E)

- SOR/97-176, s. 7

- SOR/2002-278, s. 7

- SOR/2008-191, s. 3

- Date modified: