Supplementary Death Benefit Regulations

C.R.C., c. 1360

PUBLIC SERVICE SUPERANNUATION ACT

Regulations Respecting Supplementary Death Benefits

Short Title

1 These Regulations may be cited as the Supplementary Death Benefit Regulations.

Interpretation

2 In these Regulations,

- Act

Act means the Public Service Superannuation Act; (Loi)

- department

department includes any portion of the executive government of Canada, the Senate and House of Commons of Canada and the Library of Parliament, any board, commission, corporation or portion of the public service of Canada specified in Schedule A to the Act other than a corporation or public board specified in Schedule III to these Regulations and any portion of the public service of Canada deemed by an Act of Parliament, other than the Act, to be in the Public Service for the purposes of the Act; (ministère)

- deputy head

deputy head includes the chairman, president or other chief executive officer of a department; (sous-chef)

- Minister

Minister means the President of the Treasury Board; (ministre)

- seasonal employee

seasonal employee and sessional employee have the same meaning as in the Public Service Superannuation Regulations. (employé saisonnier and employé de session)

- SOR/92-716, s. 7(F)

Manner and Time of Payment of Contributions

3 Subject to these Regulations, the contributions required to be paid by a participant shall be paid monthly by reservation from his salary.

Contributions by Participants Absent from Duty

4 A participant who is absent from duty shall contribute to the Consolidated Revenue Fund an amount equal to the amount the participant would be required to contribute pursuant to section 53 of the Act if the participant were not absent from duty.

- SOR/92-716, s. 1

5 The contributions required to be paid by a participant who is absent from duty with pay shall be paid monthly by reservation from his salary.

6 (1) Subject to subsection (2) and section 7, a participant who is absent from duty without pay shall pay the contributions that are required to be paid in respect of that absence

(a) in a lump sum within 30 days after the participant’s return to duty; or

(b) by reservation in equal instalments from the salary payable to the participant for a period equal to twice the period of absence commencing on the expiration of the period of absence.

(2) Where payment pursuant to paragraph (1)(b) would cause the participant financial hardship, the participant may choose to make payment by reservation from the salary of the participant of approximately equal instalments over a period not exceeding the lesser of

(a) three times the period of absence, and

(b) 15 years.

- SOR/91-333, s. 1

- SOR/94-540, s. 1

7 The contributions required to be paid by a participant who is referred to in section 47.1 of the Act, or who is absent from duty without pay for the purpose of serving

(a) with an international organization,

(b) with the government of a country other than Canada,

(c) as a full-time paid official of a public service employee organization,

(d) as a full-time paid official of a credit union, or

(e) outside of the Public Service with a commission established under Part I of the Inquiries Act or with any board or agency that is an agent of Her Majesty in right of Canada,

shall be paid by sending them to the Minister annually, quarterly or in a lump sum in advance, at the option of the participant.

- SOR/92-716, s. 7(F)

- SOR/99-378, s. 1

7.1 Where an amount payable by a contributor under section 4 is unpaid at the time the contributor ceases to be employed in the Public Service, the amount shall be deducted from any benefit that is or will become payable under the Act to the contributor

(a) where the benefit is an annuity or annual allowance,

(i) by reservation from the monthly instalments of the annuity or annual allowance of an amount equal to the amount of any instalment otherwise payable by the contributor under section 6 or 30 per cent of the gross monthly annuity or annual allowance, whichever is the lesser, or

(ii) in a lump sum, if the contributor so elects, at the time the annuity or annual allowance becomes payable; and

(b) in any other case, in a lump sum, at the time the benefit becomes payable.

- SOR/94-540, s. 2

Seasonal and Sessional Employees

8 The contributions required to be paid by a participant who is a seasonal employee or a sessional employee in respect of the period during which he is not on duty in the Public Service shall be paid at the time and in the manner that contributions would be payable under section 6 if he were, during that period, a participant described in that section.

- SOR/92-716, s. 7(F)

Participants Receiving Portion of Normal Pay

9 (1) Where a participant employed in a position on a full-time basis is, due to the granting of educational leave or the seasonal nature of his employment, engaged other than on a full-time basis for any period during a year or during an entire year, and during such period or during the entire year receives a portion of the normal pay for employment on a full-time basis in that position, he shall be deemed during such period or year

(a) to have been employed on a full-time basis; and

(b) to have been in receipt of such salary as he would have received had he in fact been engaged on a full-time basis during such period or year.

(2) The contributions required to be paid by a participant described in subsection (1) shall be paid at the same time and in the same manner as if he were a participant described in section 6.

Contributions by Elective Participants

- SOR/92-716, s. 8(F)

10 (1) Subject to subsection (2), every elective participant shall contribute to the Consolidated Revenue Fund $0.15 each month for every $1,000 of the basic benefit if the participant

(a) on ceasing to be employed in the Public Service is entitled to an immediate annuity under Part I of the Act;

(b) on ceasing to be employed in the Public Service after March 31, 1995 is entitled to and has opted for an annual allowance payable within thirty days after so ceasing;

(c) on ceasing to be required to contribute to the Retirement Compensation Arrangements Account by section 8 or 9 of the Retirement Compensation Arrangements Regulations, No. 1 is entitled to an immediate annuity;

(d) on ceasing to be required to contribute to the Retirement Compensation Arrangements Account by section 8 or 9 of the Retirement Compensation Arrangements Regulations, No. 1 is entitled to an immediate annual allowance; or

(e) on March 31, 1995 was an elective participant and

(i) was receiving an annual allowance under Part I of the Act and had been receiving the annual allowance since a date not later than 30 days after ceasing to be employed in the Public Service, or

(ii) had been receiving an annual allowance under Part I of the Act since a date not later than 30 days after ceasing to be employed in the Public Service but, on March 31, 1995, was entitled to an immediate annuity under that Part.

(2) The contribution required under subsection (1) is reduced by $1.50 per month, in respect of a participant who is 65 years of age or older and who

(a) on ceasing to be employed in the Public Service is entitled to an immediate annuity under Part I of the Act;

(b) is a person who is entitled to an immediate annual allowance; or

(c) on ceasing to be required to contribute to the Retirement Compensation Arrangements Account by section 8 or 9 of the Retirement Compensation Arrangements Regulations, No. 1 is entitled to an immediate annuity.

(3) The reduction referred to in subsection (2) is effective on the earlier of April 1st or October 1st after the day on which the participant attains 65 years of age.

- SOR/92-716, s. 2

- SOR/95-163, s. 1

- SOR/99-378, s. 2

11 (1) Subject to section 12, every elective participant, other than an elective participant referred to in subsection 10(1), shall contribute to the Consolidated Revenue Fund each year, in advance, for every $2,000 of the basic benefit of the participant

(a) during any period in which neither an annuity under Part I of the Act or under the Canadian Forces Superannuation Act nor a pension under the Defence Services Pension Continuation Act is being paid to the participant, the amount set out in Part I of Schedule I; and

(b) during any period in which an annuity or a pension is being paid to the participant under the Part or an Act referred to in paragraph (a), 12 times the amount set out in Part II of Schedule I.

(1.1) and (2) [Repealed, SOR/99-378, s. 3]

(2.1) Subject to section 12, a participant referred to in subsection (1) shall pay

(a) the first contribution on or before the thirtieth day after the day on which the participant ceased or ceases to be employed in the Public Service; and

(b) subsequent such contributions each year on or before the thirtieth day after the anniversary of the day on which the participant ceased or ceases to be employed in the Public Service.

(3) Where the payment of an annual contribution by an elective participant is not made in accordance with subsection (2.1), the Minister shall, where he is of the opinion that failure to make such payment resulted from the fact that the participant was misinformed as to his obligations under the Act, fix a subsequent day as the day on which that contribution is due, but the due date of each annual contribution thereafter payable by the participant shall be the anniversary of the 30th day immediately following the day on which he ceased to be employed in the Public Service.

- SOR/79-954, s. 1

- SOR/82-929, s. 1

- SOR/92-716, ss. 3, 7(F), 8(F)

- SOR/95-163, s. 2

- SOR/99-378, s. 3

11.1 [Repealed, SOR/99-378, s. 4]

12 (1) Subject to subsection (2), where an elective participant is or becomes entitled to an annuity or an annual allowance under Part I of the Act, the contributions required to be paid by him pursuant to section 10 or 11 shall, unless the participant otherwise directs, be reserved from that annuity or annual allowance when it becomes payable to him.

(2) Where an annuity or annual allowance payable under Part I of the Act to an elective participant is not sufficient to pay the contributions required to be paid by him pursuant to section 10 or 11, the participant shall pay the contributions by sending them to the Minister annually, quarterly or in a lump sum in advance, at the option of the participant.

(3) A direction made by a participant pursuant to subsection (1) shall be in writing, signed by the participant and addressed to the Minister and shall have effect on and from the first day of the month immediately following the month in which it is received by the Minister.

- SOR/92-716, s. 8(F)

13 [Repealed, SOR/99-378, s. 5]

14 Where an elective participant has paid a contribution in respect of a period longer than one month and before the expiration of that period he becomes a participant, other than an elective participant, under the Act or under Part II of the Canadian Forces Superannuation Act, there shall be paid to him an amount equal to a fraction of the last contribution he has paid, such fraction to be determined as follows:

(a) the numerator is the number of complete calendar months remaining until his next contribution would have been due if he had continued to be an elective participant; and

(b) the denominator is the total number of calendar months in respect of which the contribution was paid by him.

- SOR/92-716, s. 4(F)

Reductions in Benefits and Contributions

15 The reduction referred to in the definition basic benefit in subsection 47(1) of the Act shall be made on April 1st and October 1st of each year, whichever date immediately follows the participant’s birthday.

- SOR/78-785, s. 1

- SOR/92-716, ss. 7(F), 8(F), 9(F), 11

- SOR/99-378, s. 6

16 The reduction in the amount that certain participants are required to contribute pursuant to section 53 of the Act shall commence on April 1st or October 1st, whichever date immediately follows the anniversary of the birthday of the participant on which he became eligible for the reduction.

- SOR/92-716, s. 11

Employment Substantially Without Interruption

17 Where, during any relevant period,

(a) a person has ceased to be employed in the Public Service and has again become employed therein, or

(b) the duties or conditions of employment of a person employed in the Public Service have altered,

his service during that period shall be deemed for the purposes of Part II of the Act to be substantially without interruption unless during that period he ceased to be employed in the Public Service and did not again become employed therein within three months from the day on which he so ceased to be employed.

- SOR/92-716, s. 7(F)

Salaries in Cases of Doubt

18 For the purposes of Part II of the Act and these Regulations, the salary of a participant

(a) whose authorized salary includes any bonus or allowance of determinate or indeterminate amount shall be deemed to be the sum of the regular remuneration payable for the services performed by him in his position and the value of the bonus or allowance as fixed by the Treasury Board;

(b) who is in receipt of a salary in respect of employment in the Public Service on a full-time basis and in receipt of a salary in respect of employment in the Public Service on a part-time basis shall be deemed to be the sum of the salaries received by him in respect of such employment; and

(c) who is in receipt of more than one salary in respect of employment in the Public Service on a full-time basis shall be deemed to be

(i) in respect of salary received before August 9, 1994, the salary that was first authorized to be paid to the contributor; and

(ii) in respect of salary received after August 8, 1994, the total of all salaries received by the contributor.

- SOR/92-716, s. 7(F)

- SOR/94-541, s. 1

Persons Not in Receipt of Stated Annual Salary

19 (1) The salary that is or was authorized to be paid to a person at a rate other than an annual rate shall be computed in terms of an annual rate by multiplying the rate of pay that he is or was paid

(a) in the case of an hourly rate, by the aggregate of

(i) the number of hours in a relevant standard work week multiplied by 52, and

(ii) the number of hours in a relevant standard work week divided by the number of days in a relevant standard work week;

(b) in the case of a daily rate, by the aggregate of

(i) the number of days in a relevant standard work week multiplied by 52, and

(ii) one day;

(c) in the case of a weekly rate, by 52; or

(d) in the case of a monthly rate, by 12.

(2) For the purposes of this section the number of hours or days in a relevant standard work week is the number of hours or days, as the case may be, that the employee in respect of whom the expression is being applied is or was ordinarily required to work in the relevant work week as determined by the Minister.

Effective Dates of Ceasing to Be Employed in the Public Service

20 Subject to sections 21 and 22, a participant, other than an elective participant, shall be deemed to have ceased to be employed in the Public Service,

(a) in the case of a participant other than a participant described in paragraphs (b) to (e), on the day following the last day for which he received pay in respect of his employment in the Public Service;

(b) in the case of a participant who dies, on the day following the day of his death;

(c) in the case of a participant who is on authorized leave of absence without pay, on the earlier of

(i) the day following the day on which his deputy head advises the Minister in writing that the employee ceased to be employed in the Public Service, and

(ii) the day that, according to the provisions of any other Act of Parliament governing employment outside the Public Service, he became a contributor to any other superannuation or pension fund or plan;

(d) in the case of a participant who is on unauthorized leave of absence without pay, the day following the day on which his deputy head advises the Minister in writing that the employee ceased to be employed in the Public Service;

(e) in the case of a participant who is under suspension pursuant to the provisions of any Act of Parliament, the day he ceased to be employed in the Public Service as certified by his deputy head to the Minister; and

(f) in the case of a participant who ceases to be required to contribute under Part I of the Act by reason of becoming a person described in paragraph 5(1)(g) or (h) or subsection 5.1(1) of the Act, the day following the last day on which he or she was required to contribute.

(g) [Repealed, SOR/99-378, s. 7]

- SOR/92-716, ss. 7(F), 8(F), 11

- SOR/94-541, s. 2

- SOR/99-378, s. 7

21 (1) A participant who is a sessional employee shall be deemed to have ceased to be employed in the Public Service on the first day of the session of Parliament immediately following the session in which he was actively employed unless

(a) within a period of 10 days from that day he returns to duty; or

(b) the Speaker of the House of Parliament in which he is or was employed advises the Minister in writing that the employee will cease or has ceased to be employed on a day earlier than that first day.

(2) Subsection (1) does not apply to a sessional employee in respect of a special or emergency session of Parliament at which the employee is not required to perform any services.

- SOR/92-716, s. 7(F)

22 A participant who is a seasonal employee shall be deemed to have ceased to be employed in the Public Service on the first day he is required to return to duty following the season in which he was actively employed unless

(a) within a period of 10 days from that day he returns to duty; or

(b) his deputy head advises the Minister in writing that the employee will cease or has ceased to be employed on a day earlier than that first day.

- SOR/92-716, s. 7(F)

Retroactive Increases in Salary

23 Where a retroactive increase is authorized in the salary of a participant, such increase shall be deemed to have commenced to have been received by him on the first day of the month following the month in which

(a) the Governor in Council or the Treasury Board, as the case may be, approves such increase; or

(b) written approval of such increase was duly issued by the appropriate authority in any case where approval of the Governor in Council or the Treasury Board is not required.

Proof of Age and Marital Status

24 (1) For the purposes of Part II of the Act, proof of age shall be established in the same manner and at the same time as it is established under section 48 of the Public Service Superannuation Regulations.

(2) Unless the Minister is satisfied that a participant had not attained the age of 55 years at the time of his death, not more than 20 per cent of the benefit shall be paid upon the death of the participant until proof of his age has been established in accordance with section 48 of the Public Service Superannuation Regulations.

(3) No benefit shall be paid upon the death of a participant to any person purporting to be the widow of the participant until proof of marital status has been established in accordance with section 49 of the Public Service Superannuation Regulations.

(4) Subject to subsection 25(4) of the Act, if within one year after the death of a contributor the person claiming to be the widow of a contributor cannot prove that she is his widow, in the manner prescribed by subsection (1) of this section, the contributor shall, for the purposes of the Act, be deemed to have died without leaving a widow.

- SOR/92-716, ss. 7(F), 11

Elections

25 (1) Every election made by a person pursuant to section 51 of the Act shall be made by him in writing, in the form prescribed by the Minister and signed by the person making the election, and the original thereof shall be sent or delivered to the Minister within the time prescribed by section 51 of the Act for the making of such an election.

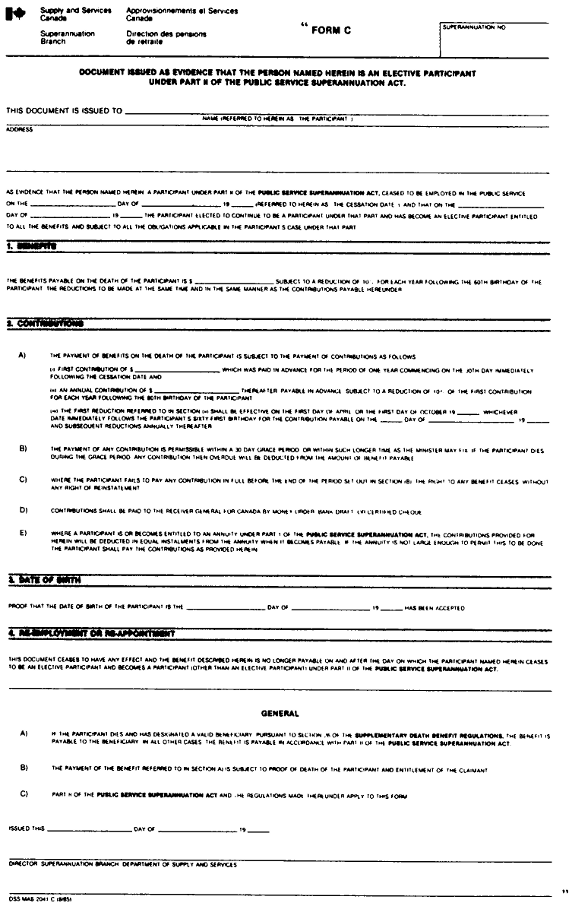

(2) There shall be issued to each elective participant, as evidence that he is a participant under the Act,

(a) a document in Form B of Schedule II, in the case of an elective participant who is required to contribute in accordance with subsection 10(1); and

(b) a document in Form C of Schedule II, in any other case.

- SOR/92-716, ss. 7(F), 8(F), 9(F), 11

- SOR/99-378, s. 8

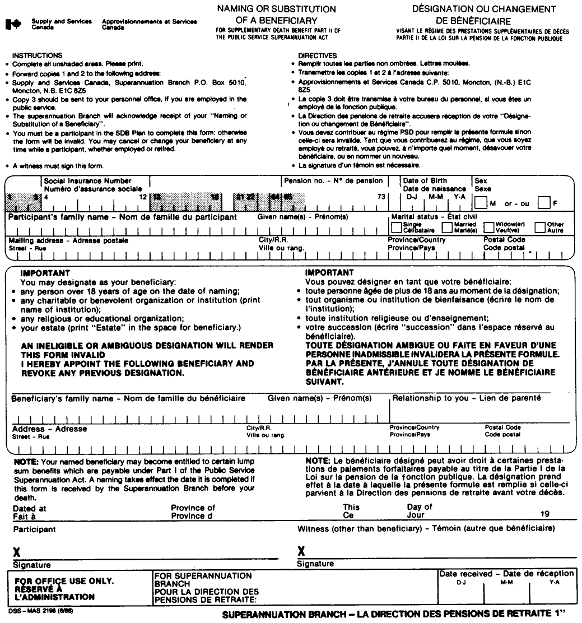

Naming or Substitution of a Beneficiary

26 (1) Subject to the provisions of this section, a participant may, for the purposes of Part II of the Act, name a beneficiary under Part II of the Act or substitute a new named beneficiary.

(2) The naming of a beneficiary or the substitution of a named beneficiary by a participant pursuant to subsection (1) shall be evidenced in writing in the form set out in Schedule V and the form shall be dated, witnessed and forwarded to the Minister.

(3) Subject to subsection (4), the naming of a beneficiary or the substitution of a named beneficiary by a participant shall be effective on the date the participant executes the form referred to in subsection (2) if the completed form is received by the Minister prior to the death of the participant.

(4) Where the completed form was not forwarded to the Minister pursuant to subsection (2) but was received by the department in which the participant is employed, or was employed prior to his ceasing to be employed in the Public Service, and the deputy head of that department advises the Minister that the form was received by the department prior to the death of the participant, the naming of a beneficiary or the substitution of a named beneficiary by a participant shall be effective on the date the participant executed the form referred to in subsection (2) if the form is received by the Minister prior to the payment of any benefit under Part II of the Act.

(5) For the purposes of Part II of the Act, a beneficiary may be

(a) the estate of the participant;

(b) any person over the age of 18 years on the date of the naming or substitution;

(c) any charitable organization or institution;

(d) any benevolent organization or institution; or

(e) any eleemosynary religious or educational organization or institution.

- SOR/86-635, s. 1

- SOR/92-716, s. 7(F)

26.1 Notwithstanding section 26, a beneficiary, named by a participant pursuant to subsection 26(1), ceases to be that participant’s beneficiary under Part II of the Act the day following the day the participant ceases to be a participant under that Part.

- SOR/80-937, s. 1

Crown Corporation and Public Boards

- SOR/92-716, s. 10(F)

27 The Crown corporation and public boards specified in Schedule III are excluded from the operation of Part II of the Act.

- SOR/92-716, s. 10(F)

28 Every Crown corporation or public board set out in Schedule IV shall pay to the Consolidated Revenue Fund each month an amount equal to $0.04 for every $1,000 of the basic benefit of each participant who is employed by the Crown corporation or public board at any time during that month.

- SOR/92-716, s. 5

- SOR/99-378, s. 9

Payment for Reasonable Expenses

29 With the approval of the Minister, there may be paid out of any benefit payable to the widow, referred to in section 55 of the Act, or beneficiary, estate or succession of a deceased participant

(a) to any person, group or association of persons any reasonable expenses incurred by such persons, group or association for the maintenance, medical care or burial of the deceased participant; or

(b) to the Receiver General reasonable expenses incurred by Her Majesty for the maintenance, medical care or burial of the deceased participant.

- SOR/78-477, s. 1

- SOR/99-378, s. 10

Interest

30 Interest shall be credited to the Public Service Death Benefit Account in respect of each quarter in each fiscal year on the last day of June, September, December and March, calculated at the rate referred to in subsection 46(2) of the Public Service Superannuation Regulations on the balance to the credit of the Account on the last day of the preceding quarter.

- SOR/92-716, s. 7(F)

SCHEDULE I(Section 11)

PART I

| Column I | Column II |

|---|---|

| Age | Annual Contribution per $2,000 of Basic Benefit |

| 19 | $ 8.07 |

| 20 | 8.31 |

| 21 | 8.56 |

| 22 | 8.83 |

| 23 | 9.11 |

| 24 | 9.40 |

| 25 | 9.70 |

| 26 | 10.01 |

| 27 | 10.34 |

| 28 | 10.69 |

| 29 | 11.05 |

| 30 | 11.42 |

| 31 | 11.81 |

| 32 | 12.22 |

| 33 | 12.65 |

| 34 | 13.10 |

| 35 | 13.58 |

| 36 | 14.07 |

| 37 | 14.59 |

| 38 | 15.13 |

| 39 | 15.69 |

| 40 | 16.29 |

| 41 | 16.91 |

| 42 | 17.56 |

| 43 | 18.25 |

| 44 | 18.97 |

| 45 | 19.72 |

| 46 | 20.52 |

| 47 | 21.35 |

| 48 | 22.23 |

| 49 | 23.14 |

| 50 | 24.11 |

| 51 | 25.13 |

| 52 | 26.20 |

| 53 | 27.34 |

| 54 | 28.53 |

| 55 | 29.80 |

| 56 | 31.14 |

| 57 | 32.58 |

| 58 | 34.12 |

| 59 | 35.80 |

| 60 | 37.65 |

| 61 | 39.77 |

| 62 | 42.02 |

| 63 | 44.40 |

| 64 | 46.92 |

| 65 | 49.58 |

| 66 | 52.38 |

| 67 | 55.34 |

| 68 | 58.45 |

| 69 | 61.73 |

| 70 | 65.30 |

| 71 | 69.15 |

| 72 | 73.33 |

| 73 | 77.87 |

| 74 | 82.80 |

PART II

| Column I | Column II |

|---|---|

| Age | Contribution per Month per $2,000 of Basic Benefit |

| 21 | $ 0.73 |

| 22 | 0.75 |

| 23 | 0.77 |

| 24 | 0.79 |

| 25 | 0.82 |

| 26 | 0.85 |

| 27 | 0.88 |

| 28 | 0.91 |

| 29 | 0.94 |

| 30 | 0.97 |

| 31 | 1.00 |

| 32 | 1.03 |

| 33 | 1.07 |

| 34 | 1.11 |

| 35 | 1.15 |

| 36 | 1.19 |

| 37 | 1.24 |

| 38 | 1.29 |

| 39 | 1.34 |

| 40 | 1.39 |

| 41 | 1.44 |

| 42 | 1.49 |

| 43 | 1.55 |

| 44 | 1.61 |

| 45 | 1.67 |

| 46 | 1.74 |

| 47 | 1.81 |

| 48 | 1.89 |

| 49 | 1.97 |

| 50 | 2.05 |

| 51 | 2.14 |

| 52 | 2.23 |

| 53 | 2.32 |

| 54 | 2.42 |

| 55 | 2.53 |

| 56 | 2.65 |

| 57 | 2.77 |

| 58 | 2.90 |

| 59 | 3.04 |

| 60 | 3.20 |

| 61 | 3.38 |

| 62 | 3.57 |

| 63 | 3.77 |

| 64 | 3.98 |

| 65 | 4.21 |

| 66 | 4.45 |

| 67 | 4.70 |

| 68 | 4.97 |

| 69 | 5.25 |

| 70 | 5.56 |

| 71 | 5.88 |

| 72 | 6.24 |

| 73 | 6.63 |

| 74 | 7.05 |

NOTE: In this Schedule, “Age” refers to the age of the participant on the thirtieth day following the day on which the participant ceases to be employed in the Public Service or the age of the participant on the thirtieth day following the day on which the participant ceases to be a member of the regular force, as the case may be.

- SOR/92-716, s. 6

- SOR/99-378, ss. 11, 12

SCHEDULE II(s. 25)

- SOR/86-633, s. 1

- SOR/86-634, s. 1

- SOR/92-716, s. 8(F)

SCHEDULE III(ss. 2 and 27)

- Crown corporations and public boards excluded from the application of Part II of the Act:

- Atomic Energy of Canada Limited

- Canadian Broadcasting Corporation

- Canadian Overseas Telecommunications Corporation

- Crown Assets Disposal Corporation

- Defence Construction (1951) Limited

- Eldorado Aviation Limited

- Eldorado Nuclear Limited

- Freshwater Fish Marketing Corporation

- Northern Transportation Company Limited

- Polymer Corporation Limited

- The Canada Council for the Arts

- The Canadian International Grains Institute

- The Canadian Wheat Board

- The Jacques-Cartier and Champlain Bridges Inc.

- The Seaway International Bridge Corporation Limited

- SOR/78-288, s. 1

- SOR/78-760, s. 1

- SOR/79-500, s. 1

- SOR/79-794, s. 1

- SOR/90-201, s. 1

- SOR/92-716, s. 10(F)

- SOR/99-378, s. 13

- 2001, c. 34, s. 17

SCHEDULE IV(s. 28)

- A corporation specified in Schedule C or D to the Financial Administration Act

- Office of the Custodian of Enemy Property

- Canada Council for the Arts

- Canadian Council of Resource Ministers

- International Development Research Centre

- Canadian Saltfish Corporation

- National Arts Centre Corporation

- The Parliamentary Centre for Foreign Affairs and Foreign Trade

- Heritage Canada

- SOR/79-794, s. 2

- 2001, c. 34, s. 17

SCHEDULE V/ANNEXE V(Section 26)/(article 26)

- SOR/86-635, s. 2

- SOR/92-716, s. 7(F)

- Date modified: